If you’re eligible for membership, we’re ready to hear from you. Not sure if you’re eligible? You can check if you qualify here.

Up to $500 could be yours!* Earn cash rewards when you bring in new deposits from outside accounts. Opt in to make your move!

Opting in is quick and simple!

Click the button in the email we sent you.

You can also call us at 877-208-8364 or opt in at any branch.

Deposit More to Earn More

Example: If your Spectrum Credit Union membership has a total balance of $75,000 on August 31 and your average month-end balance from October through January is $100,000, you’ll have balance growth of $25,000 and earn a $150 reward!*

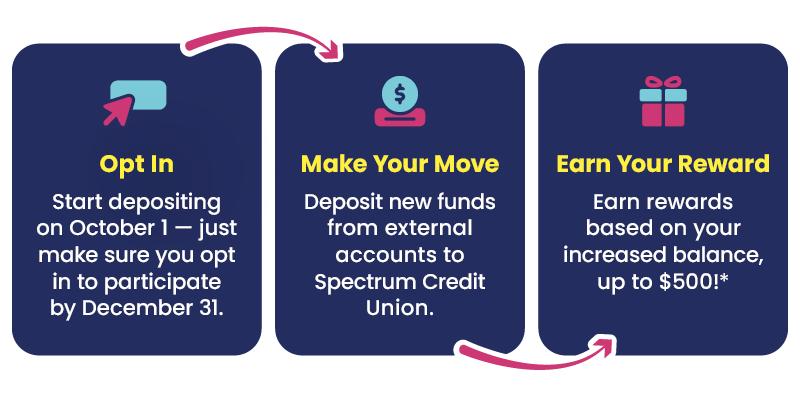

How It Works

When you bring in new deposits from outside accounts to Spectrum Credit Union, you can earn cash rewards based on your deposit amount.

It’s easy to opt in! Click the button in the email you received, call us at 877-208-8364, or stop by any branch.

Your Money Earns More Here

Why keep your money elsewhere when it could work harder for you here? At Spectrum Credit Union, your financial journey guides everything we do. This offer is one more way we reward your trust in us as your financial partner– on top of delivering savings rates up to 7x the national average.**

Make Your Move Savings Event FAQs

Which accounts qualify for the reward?

Which accounts qualify for the reward?

You can save your way – new money balances in all deposit accounts will be tracked, such as deposits into Primary Savings, Checking, Money Market Savings, and Certificates.

How is my reward amount calculated?

How is my reward amount calculated?

The month-end balance of all deposit accounts within an opted-in membership will be noted from end-of-day October 31, November 30, and December 31, 2025, and January 31, 2026.

At the end of the promotion, we will add your end-of-month balances together and divide by four to get your average month-end balance during the promotional period.

Then we’ll subtract your starting balance as of August 31, 2025, to determine the final average month-end balance of new money deposited. The result determines your reward!

What are the rewards available?

What are the rewards available?

What do you mean by average month-end balance?

What do you mean by average month-end balance?

Imagine your deposit accounts are like buckets, and the amount of money in the buckets is your balance. The amount of money in a bucket may change as you make deposits or withdrawals. The average month-end balance is a way of measuring how much money, on average, you have in your deposit accounts over a period of time.

Does it matter when I opt in?

Does it matter when I opt in?

No. You can opt in any time between September 23 and December 31. We will still look at month-end balances for October, November, December, and January.

Why does it matter when I make my deposits during the Promotional Period?

Why does it matter when I make my deposits during the Promotional Period?

Because we are tracking your average over four months, lower balances early on require higher deposits later in the promotion period to increase the average overall.

For example, if you started with a $1,000 balance, deposited $10,000 in October, and made no withdrawals during the promotion period, you would reach the $10,000 tier and earn a $100 reward.

| Time Period | End-of-month balance |

|---|---|

| October 31 | $11,000 |

| November 30 | $11,000 |

| December 31 | $11,000 |

| January 31 | $11,000 |

| Total | $44,000 |

| Divide by 4 | $11,000 |

| Subtract Starting Balance | $1,000 |

| Reward Tier = $10,000 | $10,000 |

If you waited until November to make a deposit, you would need to deposit $14,000 to earn the same reward.

| Time Period | End-of-month balance |

|---|---|

| October 31 | $1,000 |

| November 30 | $15,000 |

| December 31 | $15,000 |

| January 31 | $15,000 |

| Total | $46,000 |

| Divide by 4 | $11,500 |

| Subtract Starting Balance | $1,000 |

| Reward Tier = $10,000 | $10,500 |

Here’s another way to look at it if you only made one deposit and had no withdrawals:*

| Deposit Date | Deposit Amount | Tier Reached | |

|---|---|---|---|

| Scenario 1 | October | $10,000 | $10,000 |

| Scenario 2 | November | $14,334 | $10,000 |

| Scenario 3 | December | $21,000 | $10,000 |

| Scenario 4 | January | $40,000 | $10,000 |

I need help determining my reward potential. Can someone help me calculate this?

I need help determining my reward potential. Can someone help me calculate this?

Absolutely! Please call us at 877-208-8364 and we'd be happy to go over different scenarios to maximize your reward.

Do withdrawals affect my potential reward?

Do withdrawals affect my potential reward?

Withdrawals could affect your month-end balances, which might lower your final average balance of new money deposited. Higher deposits could help offset withdrawals.

If you are using my August 31 end-of-month balance as my starting balance, what about my September transactions?

If you are using my August 31 end-of-month balance as my starting balance, what about my September transactions?

If your savings balance grew in September, congratulations! The higher balance will help you reach your tier goal. If your savings balance decreased in September, you may have to deposit more to raise your average month-end balance.

* Examples and scenarios are for illustrative purposes only. For more information on how rewards are calculated, call 877-208-8364.

Looking for ways to save more?

Visit our Savings Hub to learn how to grow your savings faster and smarter with our savings plans and tools!

*Offer is limited to members age 18+ who are members in good standing (no active collections, fraud, or charge-offs, etc.) as of August 31, 2025. To be eligible, member must opt in to participate in the promotion by clicking the email link or contacting

a branch or Call Center representative between September 23, 2025, and December 31, 2025. All of the member’s eligible memberships will be opted in. Each eligible membership will be tracked separately for the purposes of the promotional payout.

Eligible memberships include those for which the member is an authorized signer.

The month-end balance of all deposit accounts within an opted-in membership will be noted from end-of-day October 31, 2025, November 30, 2025,

December 31, 2025, and January 31, 2026. The average of those month-end balances will then be compared to the membership’s balance as of end-of-day August 31, 2025. Only new money will be considered in calculating the increase. New money is

defined as funds deposited from sources outside of Spectrum Credit Union or Chevron Federal Credit Union.

An increase of $10,000 – $24,999.99 will earn a bonus of $100; increase of $25,000 – $49,999.99 will earn a bonus of $150; increase of $50,000 – $99,999.99 will earn a bonus of $250; and increase of $100,000+ will earn a bonus of $500.

Promotional funds will be credited to the opted-in membership’s Primary Share account as a bonus no later than March 31, 2026. Taxes due on incentives are the sole responsibility of the recipient. Spectrum Credit Union will report to the appropriate

state and federal agencies as required by applicable law. Other restrictions may apply.

International members can call 510-251-6000 to opt-in.

** National average per Bankrate as of 9/14/25 for money market savings accounts. Spectrum CU MarketEdge Money Market Savings rates of up to 3.30% APY (Annual Percentage Yield) effective 10/10/25 and subject to change without notice. See spectrumcu.org/rates/marketedge for today’s rates. Dividends are compounded daily and paid monthly.